STPLink

Straight-through processing with STPLink

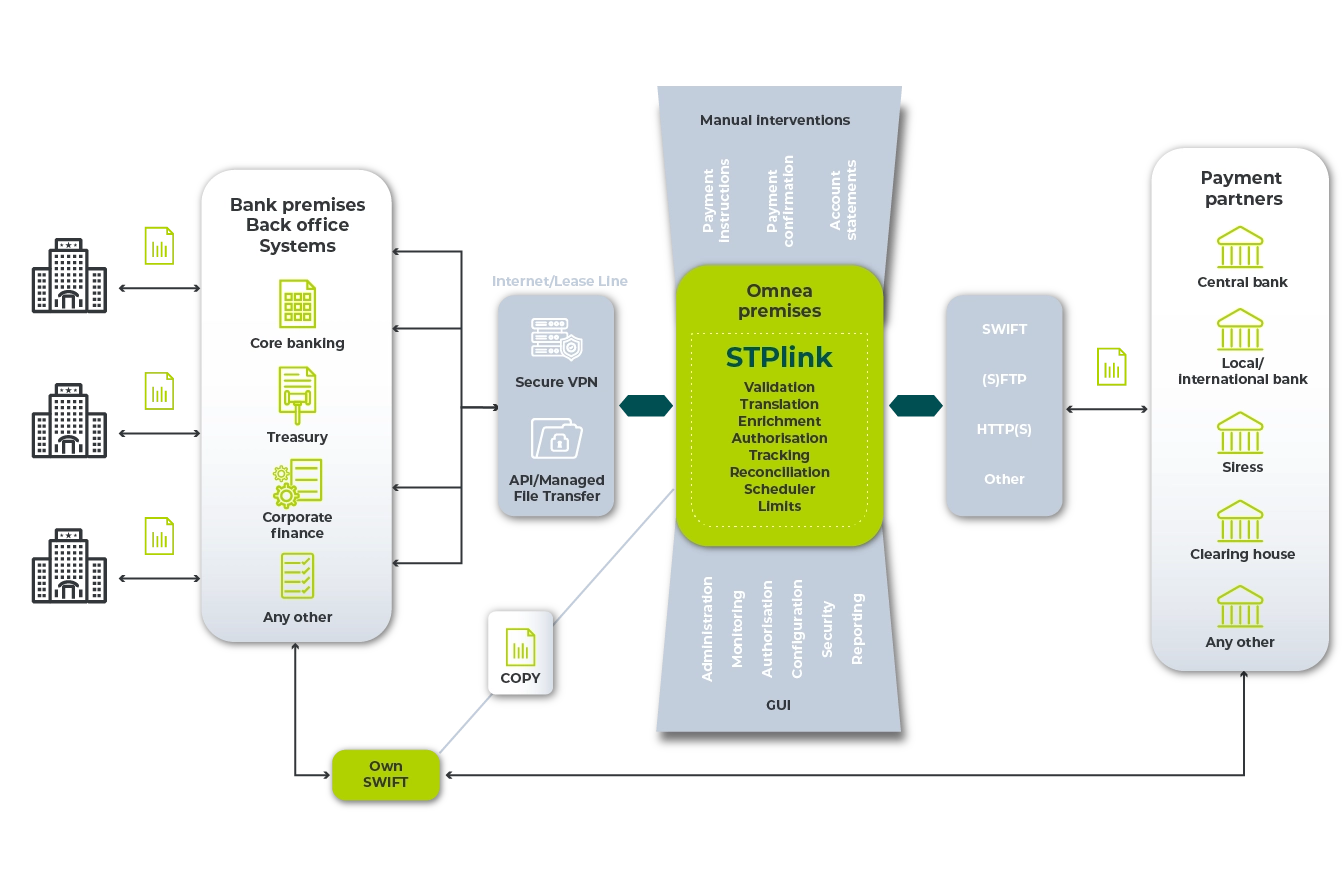

Welcome to STPLink, the cutting-edge solution that enables seamless straight-through processing for financial institutions. Developed by Omnea, STPLink is a powerful tool that helps businesses streamline their operations and maximize efficiency. Straight-through processing, or STP, is the process of automating financial transactions from start to finish, without the need for manual intervention. By automating these processes, financial institutions can reduce errors, lower costs, and accelerate transaction times. STPLink provides a simple, yet powerful solution for businesses looking to achieve STP.

With our platform, financial institutions can easily connect their systems to other businesses, such as banks and brokers, for automated transaction processing. This reduces the need for manual data entry, while increasing speed and accuracy. Our platform is designed to be flexible, and can easily integrate with existing business systems. STPLink supports a wide range of financial instruments, including stocks, bonds, and derivatives, and can be customized to meet the specific needs of each client. Security is a top priority at STPLink, and we take every measure to ensure that your data is secure.

In today's fast-paced financial landscape, businesses need a reliable and efficient STP solution to stay ahead. With STPLink, you can achieve straight-through processing with ease, while optimizing your operations and reducing costs. Contact us today to learn more about how STPLink can transform your business.

Through this capability, we have helped organisations achieve a minimum of a 50% reduction in payment transaction errors.

Accommodating annual changes to the SWIFT standards

We simplify the process associated with complying with the annual

changes to the SWIFT standards with a simple software upgrade that

contains all the necessary amendments, minimising the risk of error

and delays in sending out payment transactions during the assimilation

process as well as changes to current procedures.

We minimise the risk

Did you know that every payment transaction error costs money, either

through rework, penalties, loss of interest received, or risks associated

with delayed payments?

The built-in validation and exception handling rules for payment

instructions that STPLink provides give our customers the peace of

mind that payment transactions will be processed accurately within the

correct parameters.

How STPLink works

Benefits of STPLink

A platform built on a SWIFT-certified, internationally recognised integration solutions platform that meets all message formats.

Real-time alerts for critical conditions that require immediate attention.

Support for out-of-the box application adaptors for direct integration with other applications.

Advanced functionality such as content-based message routing, data mapping, and business process rules.

Bulk transactions into files or debulk files into transactions.

Comprehensive audit trails for all transactions and associated processes.

Simplified reconciliations.

Flexibility to adapt to changes in business processes or data standards.

Scalability to stay aligned with business growth.

Simplified monitoring of payment transactions.

Support for multiple operating system platforms, multiple delivery channels, and communication protocols, including file transfer protocols such as Connect:Direct, FTP, and SFTP, messaging middleware (MQSeries), Internet protocols (HTTPS), and industry service protocols (SWIFTNet).